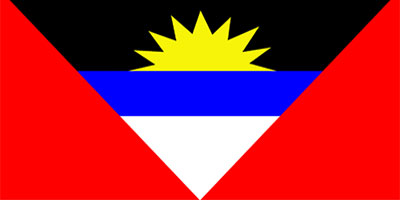

A division of: Jamaica Collections & Recovery Services Ltd.

Old Forte Road, St. George's

Tel:+1-473-440-3328(DEBT)

Fax:+1-473-440-1016

Email:caribbeanrecoverygd@gmail.com

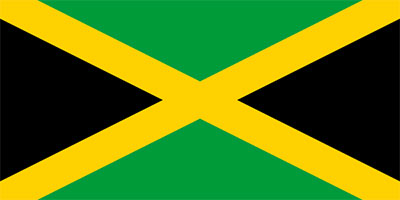

56 Montgomery Avenue, Kingston 10

Tel:(1-876) 908-2077

Fax: (1-876) 908-3774

Email:caribbeanrecovery@gmail.com

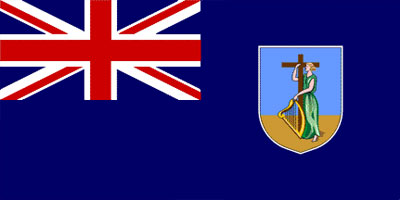

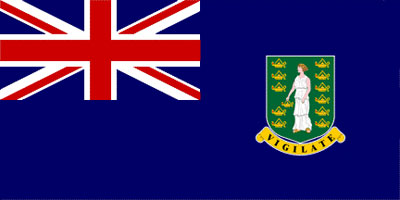

British Virgin Islands

You provide the location, audience and we will come and train you on effective collection technique, full or half day.

Sign up to receive monthly newsletter on what's happening. Read Last Month's Edition »